You may not even be aware of the term, “Advance Premium Tax Credit,” but you definitely need to understand how it impacts the amount of taxes you could owe or how much of a refund you may be entitled to.

Not only has the Affordable Care Act (ACA or ‘Obamacare’) impacted Healthcare, it has had a significant impact on taxes as well. Here’s what you need to understand about Obamacare works and how that affects your taxes.

Penalties

Most people are aware of there being a financial penalty imposed for not having health insurance due to all the controversy surrounding Obamacare. Essentially, the penalty is incurred by simply going without insurance. However, some taxpayers may be exempt from the penalty. And just what is the penalty?

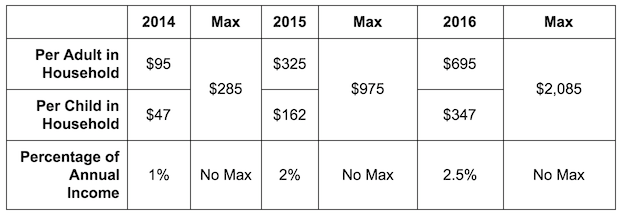

The penalty is either a flat fee or a percentage of your annual household income. Also, the penalty will increase over the next 2 years. Which method you have to pay is determined by whichever penalty method is higher. The penalties are as follows in this table:

As it may be becoming obvious to you, the penalty for not having insurance is incurred when you do your taxes. So, if you did not have insurance or were underinsured, you’ll likely either get back less of a refund or potentially owe more taxes.

Exemptions

Certain circumstances may make you eligible for an exemption(s) that could lessen the penalty if not negate it. There are 2 kinds of exemptions: a Marketplace Exemption and a Tax Return Exemption.

Below is a list of each falling under the two types of exemptions.

Tax Return Exemption

- You did not enroll in a fiscal year employer-provider plan that you were eligible for during the tax year you’re filing

- You were not without insurance consecutively for over 3 months

- You did not have valid immigration papers and were not a US citizen

- Your health care coverage was effective May 1, 2014

- You filed a 1040NR or were a US citizen living out of the country

- You were a member of a health care sharing ministry

- You were in a Limited-Benefit Medicaid or Tricare program

- You were incarcerated

- You were a member of an Indian Tribe and qualified for Indian Health Services

- Household income was below the filing requirement

Marketplace Exemptions

- Endured hardships obtaining insurance

- You were caring for a disabled or sick family member

- You were victimized by domestic violence

- You bereaved the death of a near family member

- Your property was substantially damaged due to a qualified disaster

- You filed for bankruptcy

- You were homeless

- You had your utilities shut off

- You were foreclosed on or evicted

- You were a member of a religious body that opposes insurance

- You had dependents without insurance

- Coverage options were unaffordable

- You had coverage provided by a service organization such as AmeriCorps

- You were denied medicaid

- Your insurance was cancelled

Understanding The Advance Tax Premium Credit

In order to help pay for Marketplace insurance plans, your tax credit was “given” to you at the start of the tax year as an advance and that advance went straight to the insurance provider you chose to lower your premiums.

The amount of that advance was determined by your previous tax year’s total income. So this year, your total income may be different and that difference has to be reconciled in this tax year.

So, if you made a lot more money this year, that difference in the estimated tax credit and the actual income could negatively impact your total refund or how much you owe. Conversely, if you made less than last year, it will benefit you in regards to the difference.

Again, there are other tax events that could lower or raise your taxable income and then help or hurt how much you owe or are refunded. For example, if you underestimated your gross income for this year by $3,000 but had a baby during the year, it pretty much evens out.

What To Do

We strongly recommend using a tax professional to prepare your taxes to help make sure you get every single credit and deduction you’re entitled to. Don’t sweat about the ACA and your taxes; let us handle it for you.